the doublegun investment market is in flux...fortunately, the rate of change is slow enough that classic risk vs return ratio probability analysis techniques can be employed to create scenarios for return on investment models...

anybody wish to start it off?

I have overspent on some double guns, and gotten good deals on others, and I won't sell any of them for less than what I paid (my wife would if I kicked the bucket). I get to hunt with them, which is why I bought them in the first place, which makes them all a lot of fun to own. Being in my early 50s, I probably have to wait another ten to fifteen years to see where my double gun investments are. And by then, my son will have quietly assumed ownership of all but a couple that I keep close at hand at all times. So now that I think about it, I may never get to figure out if my double rifle purchases made or lost money...

then this thread is not for you...enjoy your collection...

I never bought a gun with the idea I could make money on it, Ed. I bought McDonaldís stock when it was about $80 a share. That was an investment Ed. Investments are mostly different than guns.

I have a few guns that will sell for more than I paid for them. But, that is nothing more than a happy accident, and if Iím not around to supervise the dispersal, that notion could go straight to hell also. The happy accident is also subject to change if the next generation decides hunting and the shooting sports are passť.

Model that, ed.

Best,

Ted

Investments make money only two ways: they earn an income; and/or they are sold for more (accounting for inflation etc) than they were bought.

Guns, ordinarily, can't earn an income. That leaves capital growth. Sure, some have made good money buying cheaply and selling later at a profit, but what dividends did they forego by having their money tied up in guns? How much was eaten by insurance, storage, security, maintenance etc?

The only way I see guns being a worthwhile investment is to find sleepers and valuables that the vendors don't realise are valuable and buy them for a bargain. But that's arbitrage. It doesn't often happen, and the time and learning and legwork that goes into making those moments happen has a cost all of its own.

For those reasons, it's my opinion that investing in guns is a mug's game.

My guns are not bought with a view to what they'll be worth down the track. They're bought because I enjoy and appreciate them.

Ed I've never saw a gun you had listed that could be called an investment except on your end.

Investments make money only two ways: they earn an income; and/or they are sold for more (accounting for inflation etc) than they were bought.

Guns, ordinarily, can't earn an income. That leaves capital growth. Sure, some have made good money buying cheaply and selling later at a profit, but what dividends did they forego by having their money tied up in guns? How much was eaten by insurance, storage, security, maintenance etc?

The only way I see guns being a worthwhile investment is to find sleepers and valuables that the vendors don't realise are valuable and buy them for a bargain. But that's arbitrage. It doesn't often happen, and the time and learning and legwork that goes into making those moments happen has a cost all of its own.

For those reasons, it's my opinion that investing in guns is a mug's game.

My guns are not bought with a view to what they'll be worth down the track. They're bought because I enjoy and appreciate them.

That

looking for model data input...a clue:

what rumsfeld said:

- we know what we know...

- we know what we don't know...

- we don't know what we don't know...

you come up with the data scenarios...

i will create the models and run them through simulating algorithms to produce the charts necessary for linear risk/benefit analysis...

jOe: every gun can be an investment or not...if they are investments, then the trick is knowin when to hold erm and when to fold erm...and when to cash out...and move to a different game...

cadet: enjoy your collection...

ted: your defeatist negative attitude precludes your successful participation in this exercise...in order to win at linear investment task modeling, one needs to want to win...otherwise any success is usually the results of dumb luck...which has certainly been the secret to success for more than one investment winner...

Against my better judgement...

Another way of looking at fine, collectible double gun prices is through equilibrium price driven by supply and demand:

There's a finite (and falling, as more succumb to wear, abuse etc) number of fine vintage doubles. That's an absolute limit, which may sustain prices; but they're generally held by collectors who are at an age and stage they're looking to sell - good supply, temporarily. Gen X, Y, Millennials seem largely disinterested in the field - low demand. Until those generations get the bug, things look poorly for gun prices - which may be an opportunity if you think they'll climb again, or not, if you think it's on the wane permanently. The shrinking of hunting opportunities and general swing against hunting and shooting socially doesn't look rosy; against that though is a modest, but growing counter-culture of people who value vintage, handmade, craftsman-built stuff. Fine old guns fit that.

It certainly explains what I saw at the last auction I attended: lots of grey hair (of a couple of hundred in the room, I was almost youngest - at 40), plenty passed in after failing to make reserve, or sold below estimates.

Rocketman perhaps has some data on what prices have been doing over time?

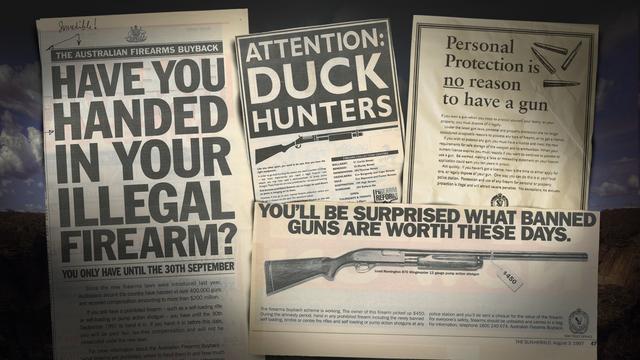

Risk analysis includes legislation that can turn guns from assets to liabilities, demographics (shrinking market) and finally liquidation ie convertability into cash. None of them are favorable at the moment.

Comparing index linked stocks to gun values over the years shows that guns are not investments.

The notion of collecting/investing in guns was alien to buyers during the golden age of the shotgun. It came about in the 1970s and 80s when inflation hedging barbarians (Gough Thomas's description of shotgun "investors") discovered guns. That time coincidentally was when the phenomenon of the "artist engraver" and signed work came about.

If the market isnt favorable now under Trump, it's almost assuredly going to get worse in two years. Guns are poor choice for investment. Gun dealers are under increasing scrutiny and regulatory requirements. Classic gun dealers are fewer and further between. Its harder ground to hoe every year.

Pretty hard to find anyone wanting a double around here.

Guns are not an investment. If you expect a positive return you better find something that is rare or tied to a famous person. Antiques in general, which most double guns are, have had a negative return for several years to as much as the last decade in some cases. Invest in real estate, bonds or the market. Play with guns and buy antiques if your wife likes them.

During the late 60's and 70's a ton of double rifles came in from India. The buyers at that time are starting to liquidate their collections now as they are in their 60's 70's or later. I watch Gunsinternational every day. Used to be an average of 99 to 100 English double rifles at any one time. Now the average is closer to 145! The dealers are advertising more and more and are trying to keep the prices up. Some doubles have been for sale for years. To add to the problem for owners is the increase in buyers fees to 20% starting to be seen in the auction houses. As an example, James Julia Auction House was bought by Morphy. Buyer fee went from 15% to 20%. That is a 33% increase! I'm guessing the rifles are off 20% from the high and now you take a further 5% loss from the auction sales as the buyer is not going to pay it. I hope it levels off.

Real Estate, Stocks and Bonds, Precious Metals, etc. all seem to me to resemble "Investments"

For me, guns are like gambling. I don't put any money into guns that I cannot afford to lose.

I find the experiential aspect of firearms to be key when considering value.

How do you put a price on the time you've spent and the friendships you've built in and around guns?

We all drive cars. The diminished value of these "things" at the end of their useful life is generally accepted without the blink of an eye.

What makes guns so holy?

When I've reached the end of my useful life, I expect to look back and smile at the time and money I've spent on guns.

I have been asking this question myself for the last couple of years since it has been showing the English gun market getting weaker. I watch the auctions and for the last couple of years it has been my opinion that English gun prices have been dropping.

I don't want to claim to be an expert but I own a few English guns and when I bought them I had hope to their value rising. I would say at this time their values have fallen at least 25%.

Now I did not buy them at the time with resale in mind, but I did hope one day if I did I could turn a profit.

I don't blame the economy as much as I blame the times and how it is changing.

The new generation does not care for the refinement of Best quality as much as just functionality.

Also the decrease in game and places to hunt is taking it's toll.

the doublegun investment market is in flux...fortunately, the rate of change is slow enough that classic risk vs return ratio probability analysis techniques can be employed to create scenarios for return on investment models....

This seems like a retailer's point of view. If so, I'd think all that means is the wholesale market for double guns is in a state of flux, whatever that means. Maybe, dealers are comfortable that their investment in inventory won't be tied up for what they deem is too long?

I wish I'd put $$ into Rolex watches. In 1975 I bought a 1969 GMT Master ("Pepsi Cola" bezel colors) used at a local jewelry store for $250. Current retail on the same used watch runs $9-10K and higher. My stepson now wears the watch. I wish I had a shoe box full of the same watch. With everything else I have adopted the investment practice of "buying high, selling low". Oh, and the watch uses obsolete jeweled movements rather than electronic. Gil

jOe: every gun can be an investment or not...if they are investments, then the trick is knowin when to hold erm and when to fold erm...and when to cash out...and move to a different game...

How can you possibly say that Ed? What if I made some great buys on semi-autos, and you got your way by supporting anti-gun Democrats, and they did what you wanted and DISARMED us?

too many people in this country possess too many semi automatic firearms...including the police.

elementary statistical theory and the law of probability indicates that the only meaningful solution to the growing number of misuses of that class of firearms is to reduce the number of semi automatic firearms now in wide distribution nationwide.

reducing the amount of anything will reduce its misuse.

Post # 400299

as for the gun control issue...we are the only country in the world that seems to tolerate mass murder, in the name of an individual right...its about time that we as a society realize that we are over gunned with too many super dangerous weapons in the hands of too many super dangerous people... it is long past time to do as the rest of the civilized world has done and simply, disarm...

disarm...seems to work for the rest of the civilized world...

why not us?

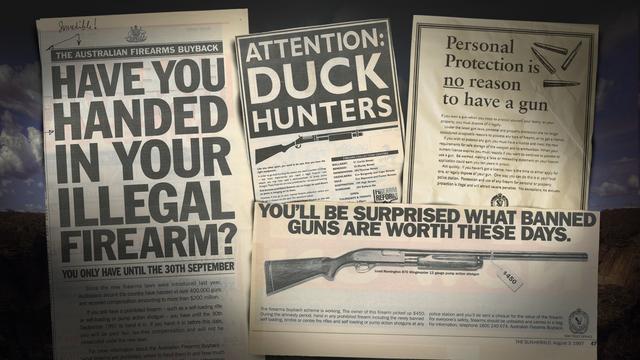

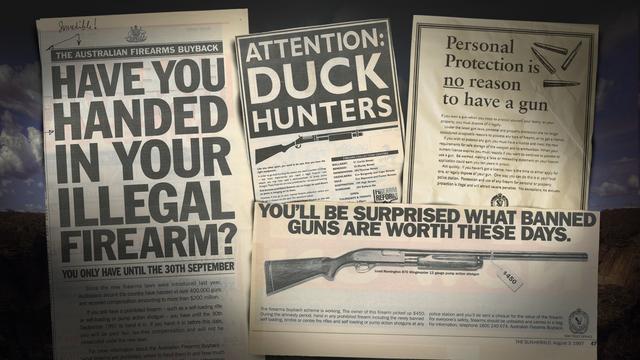

Guns wouldn't ever be a very good investment if you had your way Ed. If we were lucky, we might get $50.00 or so for them in one of those government buy-backs like they did in Australia. Or maybe they'd just confiscate them, and they become scrap metal.

I hope everyone remembers to get out and vote for pro-gun candidates tomorrow. There really is a difference between the two parties, and the only way to make Democrats stop trying to take away the gun rights of law abiding citizens is to withhold your support for them until they change their ways.

Here is a real example of stock investment. If you put 10k in Boeing stock ten years ago and reinvested dividends you would have earned 24% yearly return and have $76,762. If you did it just two years ago you would have earned a 86% yearly return and have $23,842. Or started in 11/1993 your nest egg would be $279,765 with a 14.62% return.

Stocks can be an investment, guns are toys in comparison. You canít do that with any gun. People should be happy if their toys hold value so when later sold you get your money back. Invest to retire, buy gunsvto have fun with when you retire.

keet: you came up with a classic market manipulation scheme...create the conditions where the supply of a commodity is reduced...if demand for the limited remaining supply remains constant, then prices should go up...

wonder how that is working in australia re doublegun values?

Guns as investments would take the fun out of it for me.

king: happiness is having fun making money...win, win...

sadly, did not make it to your fair ns this summer...maybe next year...

ky: but investing in stocks is no fun and can be very risky...i would rather be a pimp or hobby gun dealer, both of which can be fun and financially rewarding...with minimal risks...

gls: the demand for rare, classic anything rises in proportion to the supply of disposable financial resources in the hands of the ego driven...

classic rolexes should be on the rise...now could be a good time to invest in them...two years ago would have been even better...

"the demand for rare, classic anything rises in proportion to the supply of disposable financial resources in the hands of the ego-driven..."

You left out "Demand". Supply & Demand are what sets prices. There are many items in very short supply for which there is also no demand. These items can sometimes be had for the asking.

Even a person with an unlimited financial resource is not going to buy something they either don't want themselves or see no market for making a profit on it.

Liquidity is the issue.

You can't eat bricks and mortar.

Gunshops are filled with consingment shotguns. People only want the higher grades, the rare examples.

I think someone here previously pointed out there are gun users, and gun collectors, with some market overlap.

Good luck getting rich trading in used 870's or torch-lit clapped out doubles.

Where there is no margin, I have no mission.

2: rare and classic implies limited supply...ego driven implies irrational demand...combine the two with uncommitted financial resources, and a customer emerges...

agreed, this is not always true...for example, now is not a good time to invest in rare and classic blacksmith anvils... not a lot of ego driven demand for anvils forecast for the near future...maybe in a hundred years or so, the chic will be buying them for glass topped coffee table bases, an such; but not yet...

Miller is absolutely right about the Demand side of the law of Supply and Demand.

I have a 12 gauge Gladiator shotgun built by the same Hunter Arms Co. that made the L.C. Smith. These were being built for Sears Roebuck and Co., but the contract was cancelled after around 134 of them were built. There probably aren't very many left, so my Gladiator is rare, and in very short supply. But there is no big demand for them, and my rather rare gun is probably worth no more than $400-500.00 on a good day.

That said, I paid $100.00 for it, so even if I only double my money, it won't be a bad investment... one that I can also shoot unless Ed and King's Democrats succeed in outlawing our guns and ammunition.

That's a good reason to vote for pro-gun Republicans tomorrow.

Now finding a pro-gun Democrat these days is even harder than finding a Gladiator shotgun.

jOe: every gun can be an investment or not...if they are investments, then the trick is knowin when to hold erm and when to fold erm...and when to cash out...and move to a different game...

How can you possibly say that Ed? What if I made some great buys on semi-autos, and you got your way by supporting anti-gun Democrats, and they did what you wanted and DISARMED us?

too many people in this country possess too many semi automatic firearms...including the police.

elementary statistical theory and the law of probability indicates that the only meaningful solution to the growing number of misuses of that class of firearms is to reduce the number of semi automatic firearms now in wide distribution nationwide.

reducing the amount of anything will reduce its misuse.

Post # 400299

as for the gun control issue...we are the only country in the world that seems to tolerate mass murder, in the name of an individual right...its about time that we as a society realize that we are over gunned with too many super dangerous weapons in the hands of too many super dangerous people... it is long past time to do as the rest of the civilized world has done and simply, disarm...

disarm...seems to work for the rest of the civilized world...

why not us?

Guns wouldn't ever be a very good investment if you had your way Ed. If we were lucky, we might get $50.00 or so for them in one of those government buy-backs like they did in Australia. Or maybe they'd just confiscate them, and they become scrap metal.

I hope everyone remembers to get out and vote for pro-gun candidates tomorrow. There really is a difference between the two parties, and the only way to make Democrats stop trying to take away the gun rights of law abiding citizens is to withhold your support for them until they change their ways.

+1

keet: guess what... you and i are in agreement, re you post above...

pamt: please be aware that much of what keet posts here about yours truly is false...

for example, i do not support anti gun anybody...

and if any disarming is to be done, it should be voluntary...

and agreed, semi auto shotguns are not a good investment...

and brace yourself...the keet venom pump will engage shortly...

thus trashing this thread like so many others...ho hum, such is the nature of thing here...

I meant to tell you, Ed, (not mention,, but TELL)

that You seem to have no concept of risk within your ramblings about investment in shotguns.

So I have no idea why this thread was ever started.

Whether Keith feels compelled to bash on you or not.

There does seem to be a wisp of masochism in your more peculiar threads.

Simplify your life.

Take 100K$, buy whatever shotguns you care to fiddle with, and come back in a year. Report the time spent, the dollars in and out, and whatever you have left.

You'll learn all you need to know, and so will we.

Somehow I doubt you'll end up ahead.

I meant to tell you, Ed, (not mention,, but TELL)

that You seem to have no concept of risk within your ramblings about investment in shotguns.

So I have no idea why this thread was ever started.

Whether Keith feels compelled to bash on you or not.

There does seem to be a wisp of masochism in your more peculiar threads.

Simplify your life.

Take 100K$, buy whatever shotguns you care to fiddle with, and come back in a year. Report the time spent, the dollars in and out, and whatever you have left.

You'll learn all you need to know, and so will we.

Somehow I doubt you'll end up ahead.

Best part of that suggestion is that he'll be gone for a year!

Perhaps a two year study is in order

gee guys, all i was looking for here was data model input...

so i could run it thru some proprietary linear simulation algorithms and create a few scenarios for maximum return vs risk analysis...i was certainly willing to share privately, the results of these modeling exercises with those who provided the data...

but since no one here seems to grasp the potential impact that these models could have on their bottom line portfolios, i will let this thread drift down into oblivion, before it is trashed by the usual cast of malcontents...

but since no one here seems to grasp the potential impact that these models could have on their bottom line portfolios, i will let this thread drift down into oblivion, before it is trashed by the usual cast of malcontents...

How 'bout them Wings?

(too late, ed)

_______________________

Leggo my ego.

You're going to have to educate me, Ed. What is a proprietary linear simulation algorithm? What does it do? What sort of data, exactly, do you need to drive it? What would it tell me that a qualitative assessment of the current and potential future situations don't? Personally, I hold a modest collection (accumulation, even?) as a hobby, rather than a financial portfolio; but I do know people who genuinely hold significant fine firearms collections as portfolios as part of their superannuation; they are not happy about prices and outlooks just now.

gee guys, all i was looking for here was data model input...

so i could run it thru some proprietary linear simulation algorithms and create a few scenarios for maximum return vs risk analysis...i was certainly willing to share privately, the results of these modeling exercises with those who provided the data...

but since no one here seems to grasp the potential impact that these models could have on their bottom line portfolios, i will let this thread drift down into oblivion, before it is trashed by the usual cast of malcontents...

cadet: sorry, i have been advised that i have revealed too much already...

Oh please Ed.

Seriously, Bill Murphy spoke the best words ever uttered about trading in doubles. "The money is made on the buy."

my graduate work was in econometrics, stats. I love a good linear model. And a person could probably build a pretty good model for sxs shotguns and double rifles. The variables that influence value outcomes or predictions are not many and are already pretty well known. This would not be a tough exercise. Some of the most important variables have been listed above. The thing I think about most is "When do I get to take this gun hunting?" And that act of hunting with a well made and purpose-driven gun is the greatest return on investment I could ever have.

Taking a deer with an old English double rifle, where the immediate second shot was needed, is really cool. I get major satisfaction from that

pamt: another great post...thanks for contributing here...

and do add creative writing to your resume of skills...

Pamtnman, I am more of a Simplex tableau guy.

Ed overlooks there are actually people here that know something about Quant.

What Ted Schefelbein said +1.

Except that I sold my McDonalds stock and took profits years ago.

What Ted Schefelbein said +1.

Except that I sold my McDonalds stock and took profits years ago.

Been hovering between $175-$178. Wouldnít mind seeing a split. I do invest in things I donít understand, like, why anyone would eat there. Then I see a commercial pop up on the tube, and I am reminded they arenít marketing to me, anyway.

McDonaldís has been good. Donít get me started on RIG. A big loser.

My guns fall somewhere between those two, I suppose. But, a successful bird hunt with a decent double is itís own reward, not measured in dollars.

Best,

Ted

But, a successful bird hunt with a decent double is itís own reward, not measured in dollars.

Amen.

SRH